Ira withdrawal tax rate calculator

6 1 There are currently seven federal tax. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can.

. Colorful interactive simply The Best Financial Calculators. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705. For example if you are in the 22 tax bracket your.

Build Your Future With a Firm that has 85 Years of Retirement Experience. If its a traditional IRA SEP IRA Simple IRA or SARSEP IRA you will owe taxes at your current tax rate on the amount you withdraw. Browse Get Results Instantly.

If you want to simply take your. Ad Make a Thoughtful Decision For Your Retirement. With a traditional IRA withdrawals are taxed as regular income not capital gains based on your tax bracket the year of the withdrawal.

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. The amount changes each year. If you withdraw money from your traditional IRA before.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a. Assumptions and Limitations of the Personal Retirement Calculator. 2022 IRA Minimum Distribution Tables.

Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. Ad Its Time For A New Conversation About Your Retirement Priorities. Multiply the taxable portion of your distribution by your state marginal tax rate to figure your state income taxes on your early IRA withdrawal.

IRA Required Minimum Distribution RMD Table for 2022. Ad Search For Info About Ira tax calculator withdrawal. Ad Make a Thoughtful Decision For Your Retirement.

Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You. When owners of a Traditional IRA reach age 72 they are required to take annual minimum distributions. Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction.

The returns you can expect from your IRA depends on your investment choices. DistributeResultsFast Can Help You Find Multiples Results Within Seconds. Ad You Can Open A TIAA IRA That Fits Your Needs Potentially Save With Tax Benefits.

If youre single and your taxable income is 100000 per year for example your marginal tax rate is 24 percent which is the top bracket in which your income falls. Rate of Return. Calculate your earnings and more.

Build Your Future With a Firm that has 85 Years of Retirement Experience. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. We chose a default average return of 9 to reflect the historical long-term.

Whenever you take money from a traditional IRA you have to pay taxes at your ordinary or marginal income tax rate. For example if you fall squarely in. Since you took the withdrawal before you reached age 59 12 unless you met one.

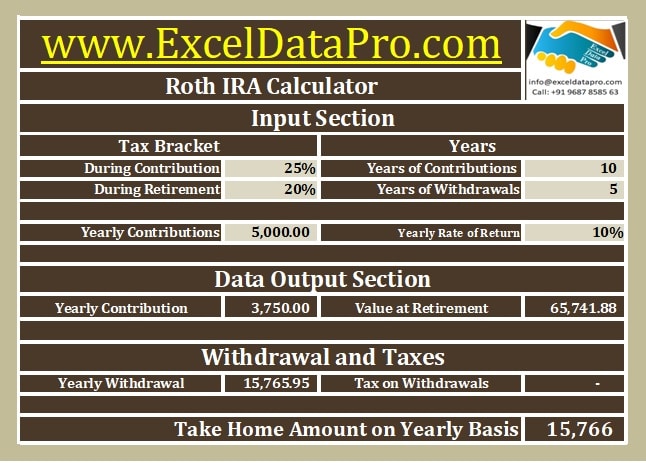

Download Roth Ira Calculator Excel Template Exceldatapro

Tax Withholding For Pensions And Social Security Sensible Money

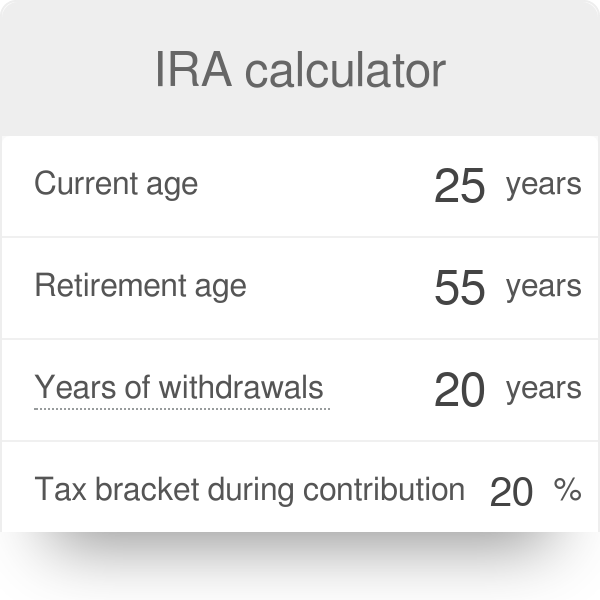

Ira Calculator

Roth Ira Calculator Roth Ira Contribution

Avoid This Rmd Tax Trap Kiplinger

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

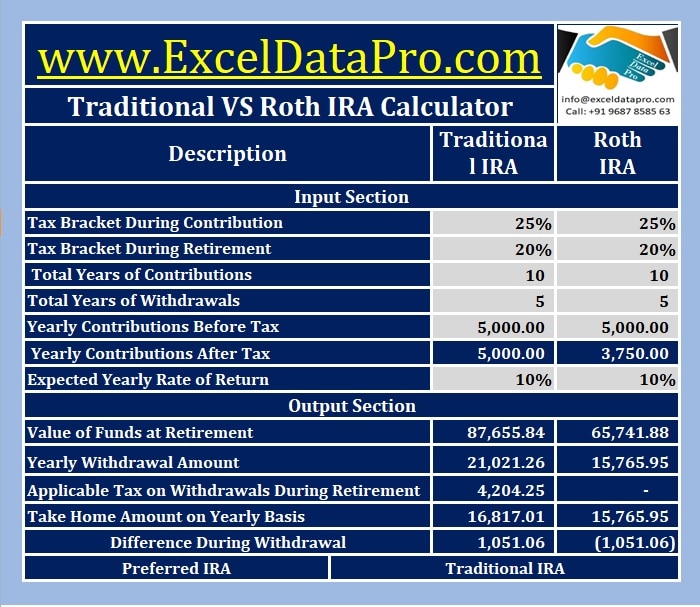

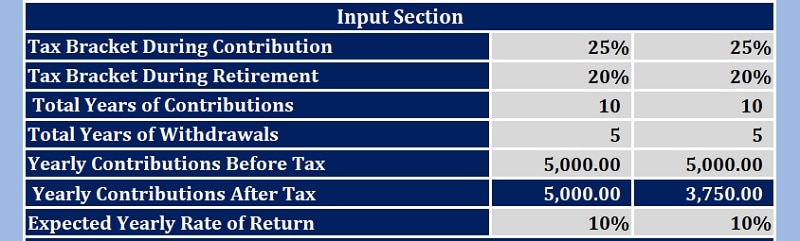

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Traditional Vs Roth Ira Calculator

Retirement Withdrawal Calculator For Excel

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator